I’ve been looking into pensions and I’ve been reading a bit more about why they even exist. I stumbled across a Government paper which talks about how to incentivise pensions which gives a few clues.

On the face of it, the pension is just a financial wrapper. It means that the money won’t be taxed at a later date.

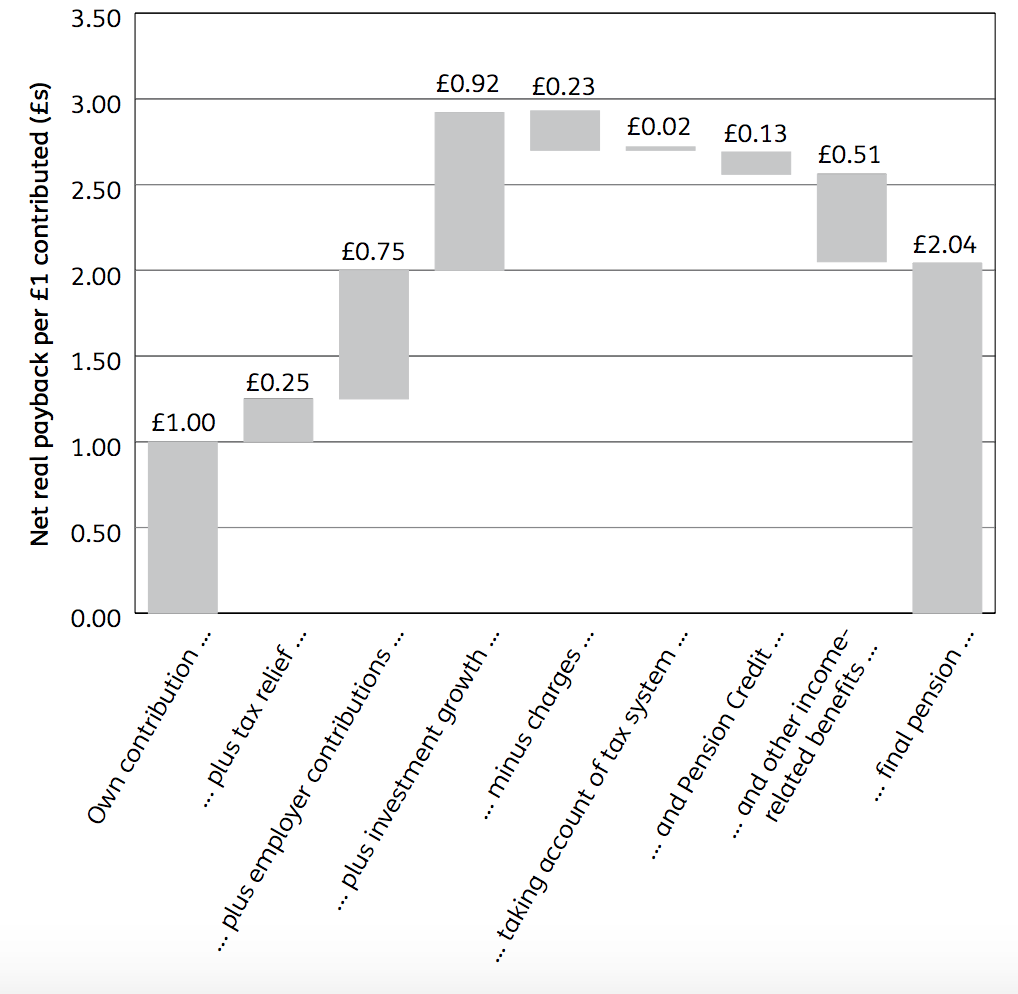

A lot of the thinking is based on this simple model:

The premise being that you need to save now to support yourself later. The model is obviously oversimplified.

“The question of the need to have incentives to try to ensure people save for their retirement has been ever-present and is perhaps symptomatic of the underlying issue that people will, if left to their own devices, tend to undersave”.

Tax has been used as a ‘nudge’ to encourage people to save. The other is now autoenrollment in the UK. We’re obliged to take out a pension and add a minimum of 3% of our annual income (if I remember), which is topped up by the employer.

But I still couldn’t figure out whether it makes financial sense to increase pension contributions, or instead use that money wisely now (thus increasing optionality AND still having assets for the period of ‘dissaving’. I couldn’t find any answers online.

What I did find was this:

The model here illustrates how it supposedly ‘pays to save’, i.e. that £1 saved in a pension will amount to £2 later on. The model doesn’t seem to take into account inflation so I don’t know whether the £2 in, e.g., twenty years buys you the equivalent of £1 of goods at todays prices (in which case it was a bad financial decision because the money was locked up the entire time). Which brings me back to me original question: does it make sense to put more money into a pension or use it wisely now (as investment for financial antifrgaility), even taking into account the tax deduction at the present time? It’s still not clear to me. If £1 is invested now and could bring a rise to 1.50 in 5 years, then surely it’s a better investment, but might be a higher risk … ?

What is clear is that the pension exists because the state evidently can’t rely on you to save (the report mentions the allure of consumerism!) and, understandably, wants to share any risk with you.

Part of our antifragile quest is so that we don’t end up living our lives like a statistic in the oversimplified model where we have a period of steady income, then retirement and ‘dissaving’, then ‘exhausted wealth’ – which sounds completely and utterly depressing. The opportunities to work and earn are vastly different now than to when such models were conceived and I think looking at pensions through the lens of antifragility is going to be a fascinating on-going conversation …